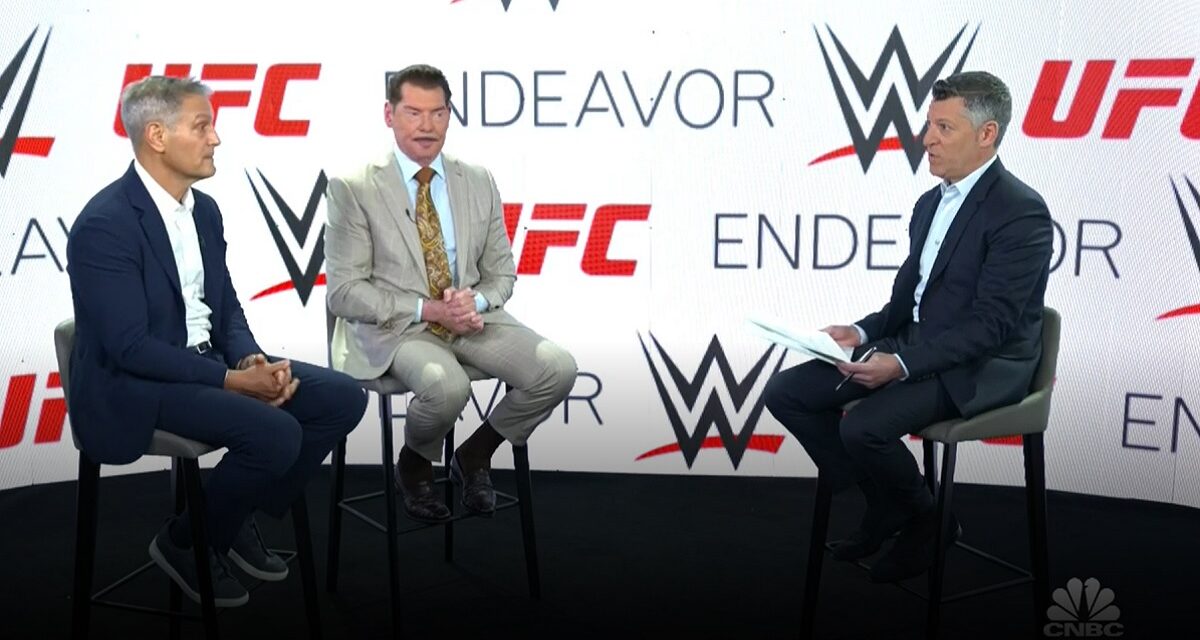

On Friday, WWE filed a lengthy SEC document outlining the terms and conditions of its merger with the UFC as part of WWE’s deal with Endeavor Inc. (UFC’s ultimate parent company).

The Information Statement / Prospectus and Notice of Action specified that the deal is not subject to any further voting by stockholders, as Vince McMahon’s controlling interest was sufficient to bind WWE into the deal. As such, the transaction will not be among the voting agenda at WWE’s upcoming annual general meeting of stockholders scheduled for May 31st.

Included in the filings was the announcement of the settlement of two class action suits – one that had been brought against Vince McMahon and one against McMahon and the company.

The cases alleged that McMahona had breached his fiduciary responsibility to minority shareholders when he used his majority powers to change the company bylaws in a move that ultimately put him back in the Board Chair position. To resolve both cases, McMahon personally paid the plaintiffs’ counsel $1.65 Million (USD), and repealed the bylaws in question, which were essentially moot after McMahon had regained his Board position.

Other notable tidbits from the Information Statement include:

- Post-merger, Vince McMahon will be appointed as the Executive Chairman of the new parent company of WWE and UFC. He will have 17% of the voting power of the new company and 34% of the economic ownership.

- In light of their significant contributions to WWE prior to and in connection with the deal, certain WWE executives will be receiving a “Sale Bonus” upon completion of the deal, as follows:

- Nick Khan – $15 Million

- Frank Riddick (WWE CFO) – $5 Million

- Paul “Triple H” Levesque – $5 Million

- Kevin Dunn – $7 Million

- With their respective stock holdings and other contractual compensation, the deal for key WWE executives could be as high as the following (including the Sale Bonus figures above):

- Nick Khan – $72 Million

- Vince McMahon – $16 Million

- Paul Levesque – $26 Million

- Frank Riddick – $20 Million

- Kevin Dunn – $31 Million

- In addition to Endeavor, WWE received preliminary sales offers from eight potential counterparties, three of which were for the outright purchase of WWE. Those deals were not considered as palatable as the Endeavor deal, as none of the suitors had the cash-on-hand to complete the purchase, and would have had to obtain financing.

- Both WWE and UFC will pay Endeavor annual fees for services including: Administrative services such as finance and accounting, tax, human resources, legal, corporate communications, and business development; and Commercial services such as streaming services, live event production, content production, ticketing and hospitality, gaming-related services, marketing and event services, and consumer product licensing. Both companies will pay $25 Million in the first year, $35 Million in the second year, and then a 1% increase for a minimum of 5 more years after that.

- WWE engaged three consulting / valuation companies (Raine Securities, JP Morgan, and Moelis & Company) to opine on the deal, and all three firms found the valuation of WWE to be financially fair.